call us

+86-189 57873009mail us

[email protected]call us

+86-189 57873009mail us

[email protected]Looking back now, what was the theme of 2024 before the outbreak of the Red Sea Crisis? Excess shipping space. Almost all forecasts believed that due to the record-breaking new shipping capacity in 2024, freight rates would definitely be under pressure, and shipping companies would have another difficult year after 2023.

As we all know what happened later, 2024 will be the most profitable year for shipping companies after 2021 and 2022. It is no exaggeration to say that the Red Sea Crisis has changed the direction of international shipping in 2024. The latest report from Alphaliner provides a detailed analysis of the actual impact of the detour around South Africa on shipping capacity and the main routes for new shipping capacity deployment, which is well worth reviewing.

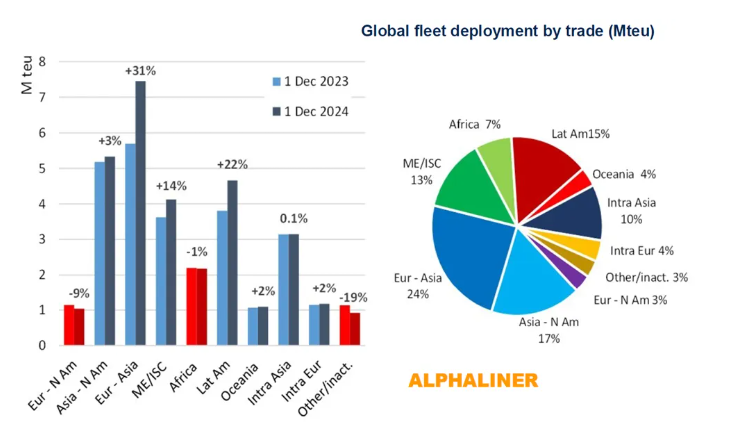

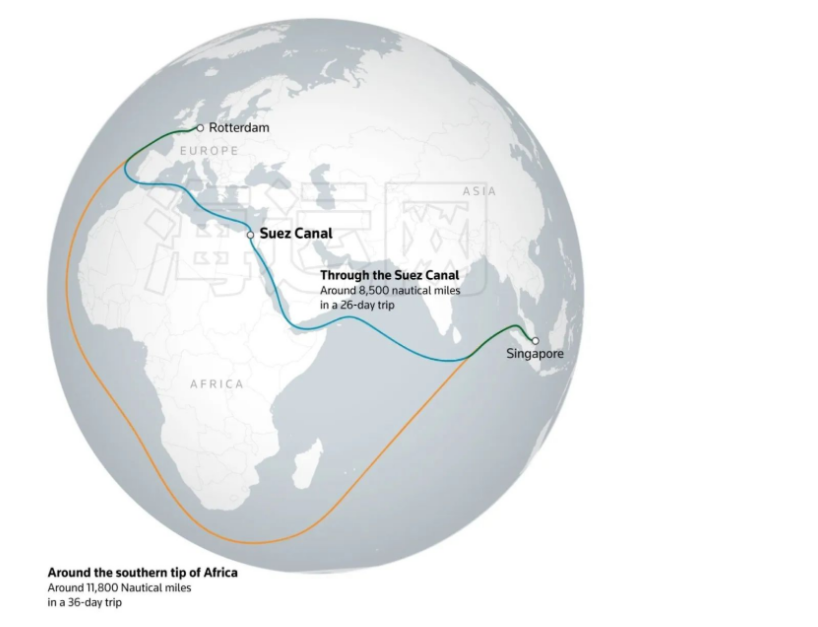

The global new nominal shipping capacity in 2024 was as high as 3 million TEU, with a year-on-year increase of 10.6%. Nearly 60% of the new shipping capacity was absorbed by the Europe route because the detour around South Africa requires more ships to maintain the original route density. Alphaliner's analysis of the Europe route in June last year showed that the nominal shipping capacity increased by 24% year-on-year, and by December it had risen to 31%. However, the actual increase in shipping capacity after the detour is far lower than this figure. On December 1, 2023, the actual weekly shipping capacity of the Europe route was about 434,940 TEU, and one year later, the actual shipping capacity only increased by 38,360 TEU, equivalent to 8.8%, far lower than the growth of nominal shipping capacity.

2024 is the first year of the Red Sea Crisis. The shipping capacity absorbed by the detour around South Africa is much higher than expected. By the end of the year, there is almost no idle shipping capacity in global shipping (only 0.6% of shipping capacity is idle). Freight rates in 2024 started low and ended high. Since the second quarter, freight rates on east-west routes have risen sharply, which is unexpected to everyone, and shipping companies have repeatedly raised their profit expectations.

The large consumption of new shipping capacity by the Europe route has a spillover effect on other routes. In 2024, the actual growth of shipping capacity on the US route was only a meager 2.9%. By December 1, 2024, only 5.1% of the new shipping capacity was deployed on the US route, less than a fraction of that on the Europe route. The actual cargo volume on the US route has increased significantly, while the increase in actual shipping capacity is very small, and shipping capacity has risen rapidly in a short period (starting from the second quarter). Global shipping is like a chess game. Can we say that the Europe route has made the US route successful?

Interestingly, outside the Europe route, the most significant growth in shipping capacity is on the Latin America route, with a nominal shipping capacity increase of 22.4% year-on-year, and 16.9% of the new shipping capacity was deployed on the Latin America route, both on ocean-going routes and regional routes in Latin America. In recent years, the Latin American market has been generally favored and has become one of the main battlefields for shipping companies to deploy shipping capacity.

The FAK freight rate on the US route was at a high level at the beginning of 2025. With multiple factors superimposed, the freight rates on the east and west coasts in January will be the high point of this year. The fully buffed 2024 has passed, and 2025 is another unusual year. The new shipping capacity this year will be less than that of last year. The shipping consultancy Dynamar predicts that around 220 new ships will be launched in 2025, with a total new shipping capacity of approximately 1.9 million TEU. Excluding scrapped shipping capacity, the nominal shipping capacity will increase by about 6% year-on-year. How much will the demand increase this year? It is generally believed to be around 2 - 3%, lower than the growth of shipping capacity.

The Red Sea Crisis that began in 2024 has greatly changed the supply and demand relationship in international shipping. The detour around South Africa has become the new normal. The geopolitical situation in the Middle East has unexpectedly changed at the end of last year, but there is still no clear timetable for when all parties can reach a reconciliation and the Red Sea can resume navigation. The detour around the Red Sea due to the crisis has absorbed so much shipping capacity. If it is released, the actual growth of shipping capacity will greatly change the supply and demand relationship, and overcapacity will become a reality. The problem is that it is still unclear when normal navigation will resume. Even if the crisis is resolved, it will be a slow process for so many ships to return to the Red Sea and will not be completed overnight. In addition to the US economy itself, external factors (tariffs) will still play a dominant role in affecting the demand on the US route in 2025. How much will the tariffs be increased? When will they be increased? How many times will they be increased? These uncertainties will change the cargo volume trend on the US route in 2025 and also determine the rise and fall of short-term freight rates.